Nothing Good Typically Ever Happens After 25 Vol

Ryan Poirier, ASA, CFA, FRM | Head of Applied Research | ryan@saltfinancial.com

Picture this: you are out with friends, having the time of your life, and the clock strikes midnight.[1] Do you power down and go home? After all, nothing good happens after midnight, right? While usually a good rule of thumb, it is not necessarily axiomatic. Nothing is that absolute except for death and taxes. The more accurate phrase might be ‘nothing good typically happens after midnight.’ It could be a good time until sunrise. But the probability of someone needing bail money only increases the later it gets.

The relationship between volatility and market returns has a similar story. Just like partying into the wee hours of the morning, investing when market volatility is very high typically only leads to trouble. Generally, high volatility is accompanied by negative returns and vice versa for low volatility.[2]

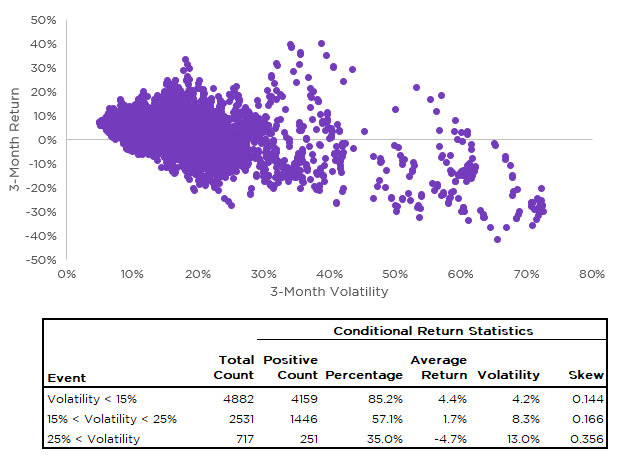

Exhibit 1: Conditional Return Given Volatility Regime

Source: Salt Financial. Returns and volatility based on the S&P 500 Total Return Index. Data from January 4th, 1988 through June 30th, 2020.

Two key observations emerge from Exhibit 1. First, we confirm the clearly negative relationship between return and volatility. But more importantly, the dispersion of returns tends to get larger as volatility increases—the odds of a really bad or a really good period occurring increase dramatically. The market environment following the global outbreak of COVID-19, with its unprecedented volatility, already experienced plenty of both.[3] For example, YTD the S&P 500 has recorded 2 out of the top 4 best days in history, according to total return data from Bloomberg going back to January 4, 1988. However, it also holds the record (and runner-up!) for the worst day, surpassing even those during the Global Financial Crisis.[4]

Market timing can be incredibly difficult. But staying on the sidelines when market volatility is high can be a smart strategy–if you have the right tools. You may miss some of the biggest days on the upside, but on average those high volatility days are nothing but trouble. A dynamic strategy that can effectively reduce exposure when volatility rises has the potential to generate better risk-adjusted returns. More often than not, calling it quits before the clock strikes 12 and heading to bed pays off the next day.

[1] No, a night out with friends at a crowded bar would not be advisable during the current global pandemic. But we are hopeful for a point sometime in the near future!

[2] The correlation between the Cboe Volatility Index (VIX) and S&P 500 daily returns was -0.7 from January 1990 through March 2020, according to data from Bloomberg. This is commonly referred to as the leverage effect.

[3] The Cboe VIX index hit an all-time high of 82.69 on March 16, 2020 and is currently hovering around 30, or approximately the 90th percentile historically.

[4] March 13, 2020 registered a return of 9.32%, while March 24, 2020 closed up 9.39%. These two are only eclipsed by October 28, 2008 and October 13, 2008, when the market soared double digits in one day at 10.79% and 11.58%, respectively. March 16, 2020 was the worst day, shaving 11.98%. March 12, 2020 took the second spot, falling 9.49%.

The information provided herein is for information purposes only and is not intended to be and does not constitute financial, investment, tax or legal advice. All investments are subject to risks, including the risk of loss of principal. Past performance is not an indicator of future results.

The information and opinions contained in Salt’s blog posts, market commentaries and other writings are of a general nature and are provided solely for the use of Salt. This content is not to be reproduced, copied or made available to others without the expressed written consent of Salt. These materials reflect the opinion of Salt on the date of production and are subject to change at any time without notice. Due to various factors, including changing market conditions or tax laws, the content may no longer be reflective of current opinions or positions.

The information contained herein is not intended as a recommendation to buy, hold or sell any security. The investment performance described herein is simulated and does not reflect actual performance data. Actual investment performance may vary. There is no guarantee that an investment will be profitable and all investments bear the risk of partial or complete loss of capital. Past performance is not an indicator of future results.

Any market observations and data provided are for informational purposes only. Where data is presented that is prepared by third parties, such information will be cited, and these sources have been deemed to be reliable. However, Salt does not warrant the accuracy of this information. Salt and any third parties listed, cited or otherwise identified herein are separate and unaffiliated and are not responsible for each other’s policies, products or services.