The biggest momentum ETF in the market just got a makeover as of November 30th—and not everyone may like its new haircut. iShares’ MTUM is approximately $10 billion in size and tracks the MSCI USA Momentum Index, which targets large and midcap stocks showing the strongest price momentum over both 6- and 12-month periods. [1] The index (and ETF) rebalances twice per year, most recently this past Friday November 30th.

Momentum strategies suffered with the market decline in October and November, with MTUM (as a proxy) falling 8.6% from September 30th through November 30th. [2] But momentum has managed to hold on to its strong gains for the year, with MTUM again as a proxy posting a 6.3% total return through November 30th. [3] However, the rebalancing of MTUM on Friday has radically altered the characteristics of the fund, most obviously in its sector allocations.

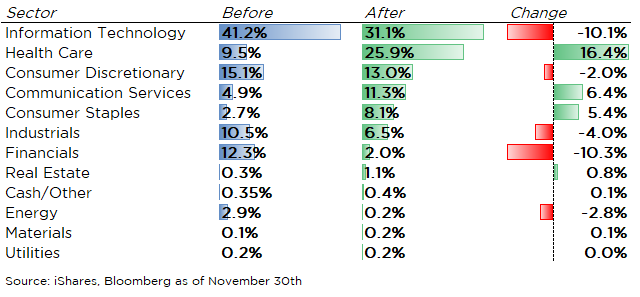

The biggest changes are the sharp reduction in technology exposure (41.2% to 31.1%) and the more than doubling in health care (9.5% to 25.9%). However, some of this reduction in technology weighting is offset by a significant increase in communications services, which contains a good number of internet stocks that were formerly classified as technology. [5] Financials and industrials were also significantly reduced. Consumer staples—traditionally more defensive in nature—were increased from 2.7% to 8.1%.

A shuffling of sectors is expected in a strategy like this targeting trailing price action. But even more interesting is the dramatic shift in market sensitivity. Prior to rebalancing, MTUM was a more volatile strategy, chock full of high-fliers with higher betas than the market. As of Friday, the 100-day historical volatility for MTUM was 21.3% in comparison to 14.9% for the SPDR S&P 500 ETF (SPY). [4] Using our truBeta™ methodology of estimating market risk, the weighted average beta for the components of MTUM was 1.19. This means the fund tended to vary about 20% more than the S&P 500 and generally in the same direction. After the rebalance, the average truBeta™ for fund components collapsed to 1.01. [6] With the boosting of traditionally lower beta sectors such as health care and consumer staples and the reduction in technology, the deflation in fund beta should not be a surprise.

The change in attitude by MTUM in terms of market beta is neither good nor bad—it is a rules-based, transparent index and is simply following its methodology. If the bout of volatility in October and November is a sign of things to come, the shift to a lower beta could be fortuitous. But if the bull market continues, MTUM may struggle to maintain its outsized performance in the near-term, especially in technology.

A strategy like momentum is generally designed for the long term and often paired with other strategies in a diversified portfolio. But it is important for investors to understand that MTUM is currently a very different animal than it was last week, so expectations should be adjusted accordingly. It’s playing the same tune, only without the amp—at least for the next six months.

[1] Momentum investing—trend-following strategies—have become popular in recent years, and not just with traders and hedge fund types. Large quantitative managers like AQR have successfully used momentum, often paired with other strategies that tend to be less volatile, in managing billions of dollars in assets on behalf of pension funds, endowments, and other institutions. And while it may remain controversial among some in academia, there is a body of evidence supporting its ability to generate excess returns over time.

There is no “standard” method of calculating momentum—there are many different look-back periods and signals that can be used. For additional details on the methodology for the MSCI USA Momentum Index, see https://www.msci.com/documents/10199/f3a22268-affd-478a-b7a7-50dc90fad923.

[2] Source: Bloomberg

[3] Source: Bloomberg

[4] Source: Bloomberg

[5] The Global Industry Classification Standard (GICS), jointly owned by MSCI and S&P Dow Jones Indices, reorganized its telecom sector into a new “communications services” sector composed of telecom, internet, and media stocks, most of which were formerly classified in the technology sector.

[6] Source: Salt Financial. truBeta™ is a proprietary estimate developed by Salt Financial that uses a blend of intraday, daily, and monthly historical return data to forecast market beta over the next quarter.

Adaptive Indexing Starts with the Right Partner

Don't miss the next release

Be the first to know when Salt publishes its latest analytics, research, and insights

Disclaimers

The information provided herein is for information purposes only and is not intended to be and does not constitute financial, investment, tax or legal advice. All investments are subject to risks, including the risk of loss of principal. Past performance is not an indicator of future results.

The information and opinions contained in Salt’s blog posts, market commentaries and other writings are of a general nature and are provided solely for the use of Salt. This content is not to be reproduced, copied or made available to others without the expressed written consent of Salt. These materials reflect the opinion of Salt on the date of production and are subject to change at any time without notice. Due to various factors, including changing market conditions or tax laws, the content may no longer be reflective of current opinions or positions.

The information contained herein is not intended as a recommendation to buy, hold or sell any security. The investment performance described herein is simulated and does not reflect actual performance data. Actual investment performance may vary. There is no guarantee that an investment will be profitable and all investments bear the risk of partial or complete loss of capital. Past performance is not an indicator of future results.

Any market observations and data provided are for informational purposes only. Where data is presented that is prepared by third parties, such information will be cited, and these sources have been deemed to be reliable. However, Salt does not warrant the accuracy of this information. Salt and any third parties listed, cited or otherwise identified herein are separate and unaffiliated and are not responsible for each other’s policies, products or services.

Prev

Prev