Overslept? No Problem, Trading Late in the Day Proves Fruitful

Ryan Poirier, ASA, CFA, FRM | Head of Applied Research | ryan@saltfinancial.com

- Buying the SPY at the close and then selling it the following morning at the open would have produced a positive return in 2018, despite buy-and-hold producing a negative return.

- Evidence shows that afternoon returns–defined as the last hour of trading–are the only portion of daytime returns statistically greater than zero.

- The 90-minute window from 2:15PM to 3:45PM over the last ten years has shown to be the profitable intraday period to hold stocks.

Money never sleeps when it comes to stock market returns. Daytime (open-to-close holding period) and overnight (close-to-open holding period) have shown a large divergence over the past 25 years.

In February of 2018, The New York Times spoke to the difference, reporting “daytime is for losers”. They cite analysis by Bespoke Investment Group, which extended an academic study [1] done in 2008 exploring the difference in daytime versus overnight returns of various markets. Bespoke finds overnight returns accounted for all the positive return of the SPDR S&P 500 ETF (SPY) since 1993, while the daytime return produced a slightly negative overall return.

The strategy has since resurfaced on the back of a particularly poor fourth quarter in 2018. Holding the SPY overnight (i.e. buying at the close and selling at the open) was an effective strategy in 2018. It had a return of 14.7%, despite a buy and hold strategy falling 4.6%, a gap of over 19%.

The original 2008 study was unable to attribute this anomaly to several tested market factors. However, a more recent academic study [2] attempts to fill in the gaps. In the paper, the authors hypothesize that investors holding overnight are more likely to be a long-term investor, thus demanding an extra premium for bearing the higher overnight risk. Conversely, daytime investors tend to be risk seeking agents, putting downward pressure on the future return of risky assets. In other words, “high risk–high reward” may only be applicable during non-trading hours.

The 2008 paper also mentioned another timing phenomenon that might interest traders dreaming of waking up in Hawaii to trade the NY markets for a couple hours and then going surfing. They find evidence of late afternoon returns–defined as the last hour of trading–being the only portion of daytime returns that matter. They find these late-afternoon returns to be 1.43%, with a t-statistic of 2.48, implying little chance this outsized return was generated purely by luck.

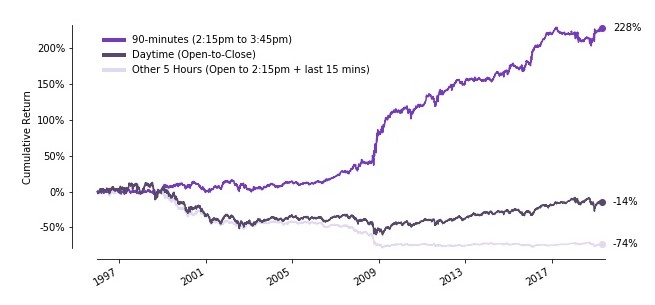

However, we find an even stronger period for returns when slicing the day into slightly different time intervals. The 90 minutes from 2:15pm to 3:45pm exhibit a materially larger divergence than simply the last hour. This splits the day into three sessions: 9:30am to 2:15pm (low return), 2:15pm to 3:45pm (high return), and 3:45pm to 4:00pm (low return). Since 1996, the cumulative return was 228% over this 90-minute afternoon trading window (2:15PM to 3:45PM), despite the return from holding the SPY from open-to-close being -14%. Investing during the other five hours (the open through 2:15PM and the last 15 minutes of trading) resulted in a cumulative loss of nearly three-fourths (-74%) the original wealth. [3]

Trading Late in the Day May Prove Fruitful

Source: Salt Calculations. Data from January 1st, 1996 till April 24th, 2019.

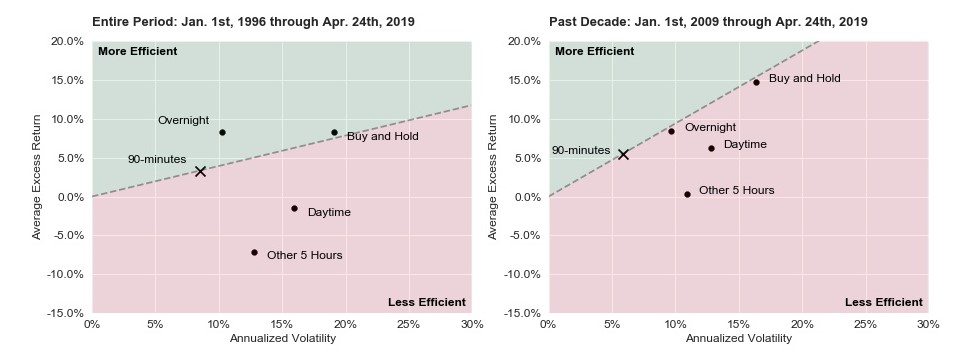

Risk-adjusted returns, defined by the Sharpe Ratio, for this 90-minute trading strategy were similar to a buy and hold strategy over the same period (left panel). However, the 90-minute strategy was superior over the last decade (right panel), outpacing daytime returns, buy-and-hold returns, and even overnight returns in terms of risk/reward trade-off.

Risk-Adjusted Returns—Intraday, Overnight, and Buy and Hold

Source: Salt Calculations. Data from January 1st, 1996 till April 24th, 2019.

Warren Buffett may advocate buying the index and holding it for long periods of time as the best course of action for the average investor. But the last decade has shown an investor only needed about 6% of the 24-hour day to achieve a more efficient risk-adjusted strategy.

If you are one to oversleep, don’t fret, the party doesn’t start until late in the day anyway.

[1] Cliff, M., Cooper, M., & Gulen, H. (2008). Return Differences between Trading and Non-trading Hours: Like Night and Day. PDF version available at https://krannert.purdue.edu/faculty/hgulen/Day_and_Night.pdf

[2] Hendershott, T., Livdan, D., & Rösch, D. (2018). Asset Pricing: A Tale of Night and Day. Available at SSRN: https://ssrn.com/abstract=3117663

[3] No transaction costs were incorporated into this analysis.

Adaptive Indexing Starts with the Right Partner

Don't miss the next release

Be the first to know when Salt publishes its latest analytics, research, and insights

Disclaimers

The information provided herein is for information purposes only and is not intended to be and does not constitute financial, investment, tax or legal advice. All investments are subject to risks, including the risk of loss of principal. Past performance is not an indicator of future results.

The information and opinions contained in Salt’s blog posts, market commentaries and other writings are of a general nature and are provided solely for the use of Salt. This content is not to be reproduced, copied or made available to others without the expressed written consent of Salt. These materials reflect the opinion of Salt on the date of production and are subject to change at any time without notice. Due to various factors, including changing market conditions or tax laws, the content may no longer be reflective of current opinions or positions.

The information contained herein is not intended as a recommendation to buy, hold or sell any security. The investment performance described herein is simulated and does not reflect actual performance data. Actual investment performance may vary. There is no guarantee that an investment will be profitable and all investments bear the risk of partial or complete loss of capital. Past performance is not an indicator of future results.

Any market observations and data provided are for informational purposes only. Where data is presented that is prepared by third parties, such information will be cited, and these sources have been deemed to be reliable. However, Salt does not warrant the accuracy of this information. Salt and any third parties listed, cited or otherwise identified herein are separate and unaffiliated and are not responsible for each other’s policies, products or services.

Prev

Prev